Writing an invoice is a crucial part of running a small business or freelance operation. An invoice is more than just a bill—it’s a formal document that ensures both parties understand the terms of the transaction and can help maintain a professional relationship. In this comprehensive guide, we will walk you through the key steps of how to write an invoice using an Excel template, including essential elements, tips for creating clear and effective invoices, and how to avoid common mistakes. We will also provide guidance on how to use our free invoice generator to simplify the process.

What is an Invoice?

An invoice is a document sent by a seller to a buyer requesting payment for goods or services provided. It outlines the amount due, the terms of the payment, and other important details related to the transaction. For small business owners, freelancers, and contractors, knowing how to write an invoice properly is essential to ensure timely and accurate payments.

Key Elements of an Invoice Using an Excel Template

To write an invoice that is clear, professional, and legally sound, you need to include the following critical information.

If you want to skip the hassle of using excel, try our free invoice generator! It makes it easy to make a invoice and ensures you do not make any mistakes

Access our template here and follow along the instructions

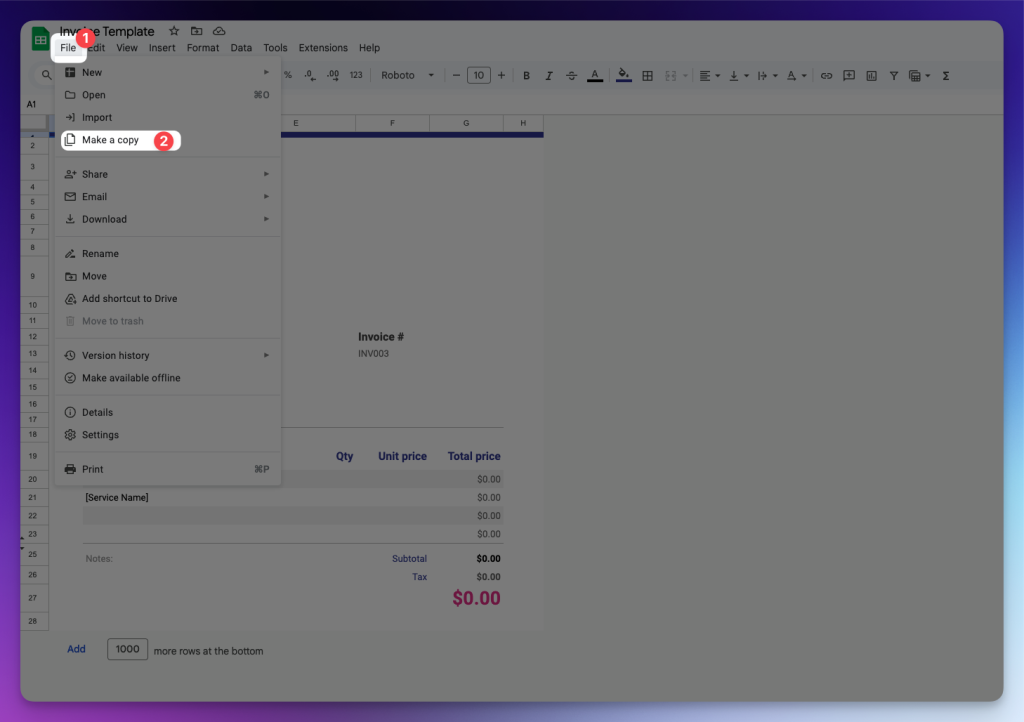

1. Make a copy of the template

- Click file in the top left corner

- Click Make a copy

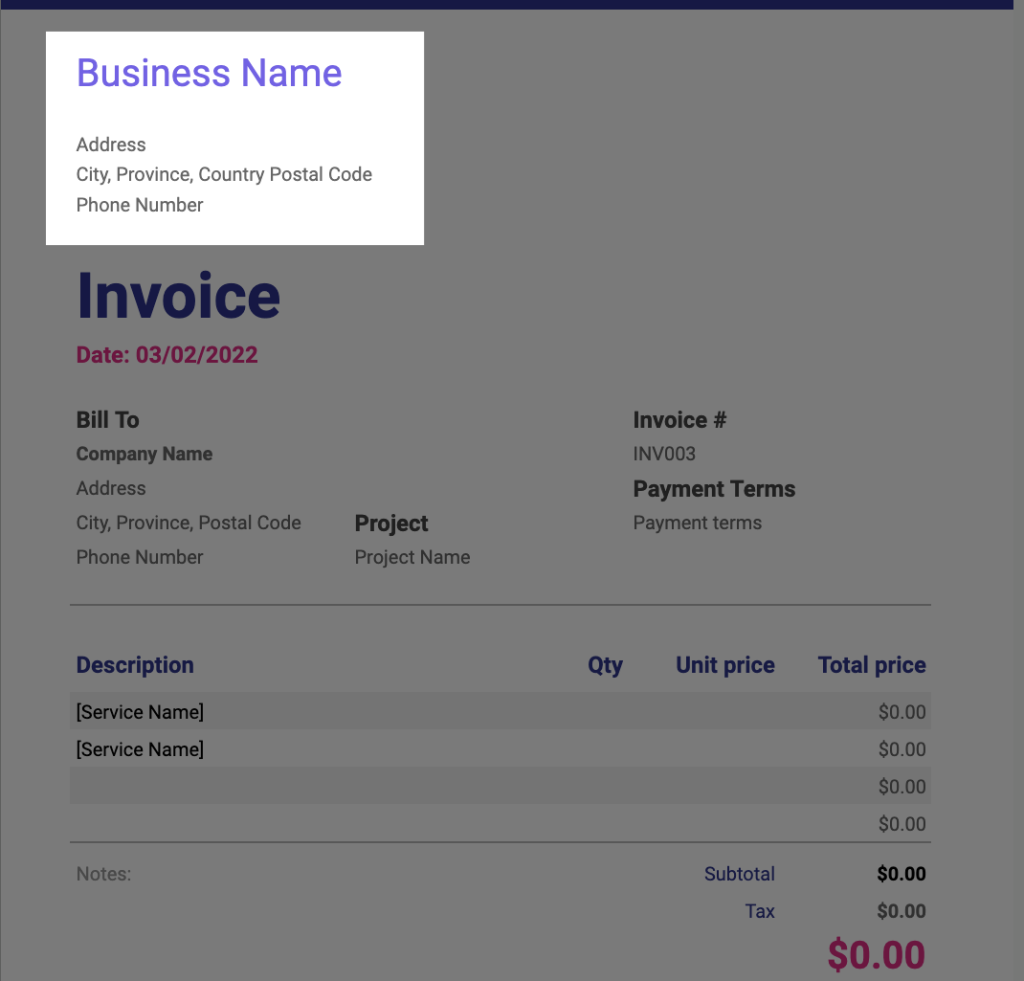

2. Your Business Information

At the top of the Excel invoice template, include your business name, logo (if you have one), and contact details (address, email, phone number). This makes it easy for the client to identify the invoice’s source and contact you if needed.

3. Client’s Information

Include the full name (or business name) and contact details of your client in the designated cells of the Excel template. This ensures the invoice reaches the correct recipient and that there are no mistakes in the billing process.

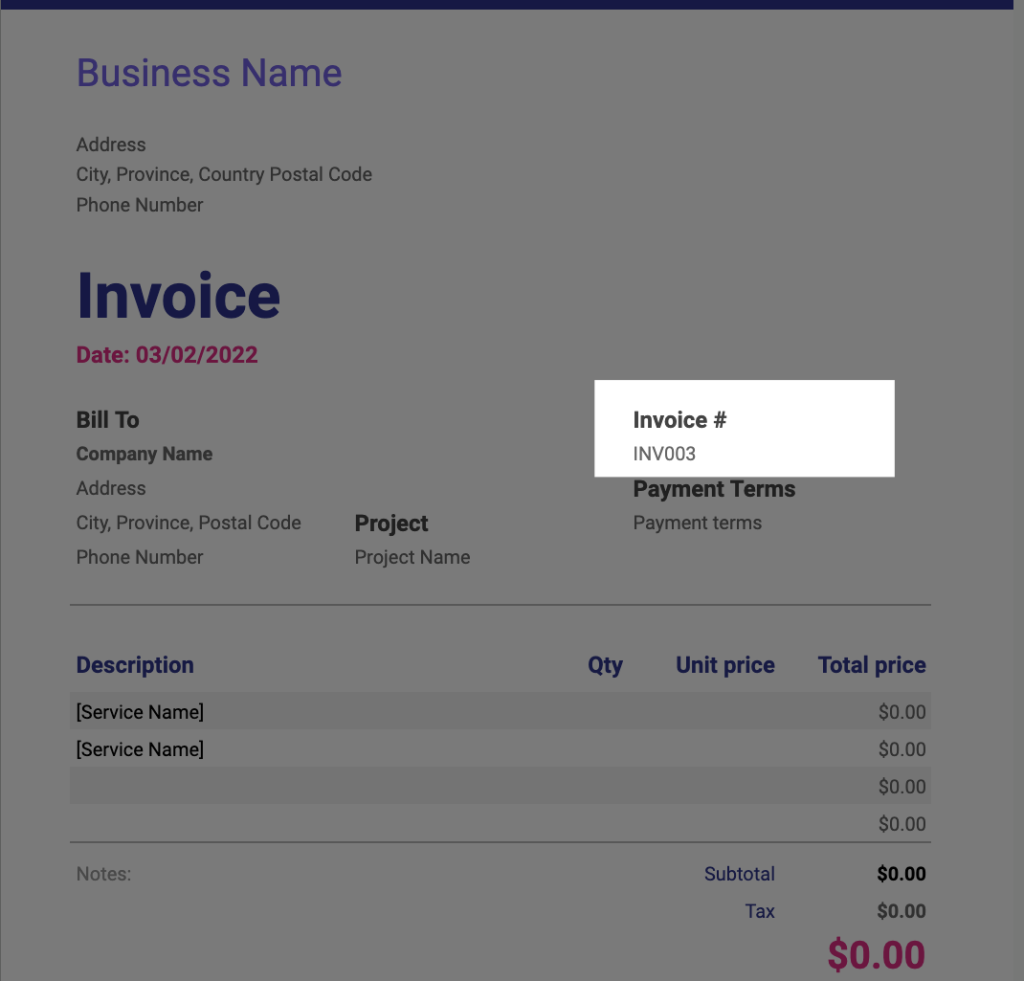

4. Invoice Number

Each invoice should have a unique invoice number. This number helps you keep track of all your transactions and is vital for accounting purposes. In the Excel template, use the Invoice Number cell to enter a sequential or personalized number (e.g., #001, #002, or using client initials).

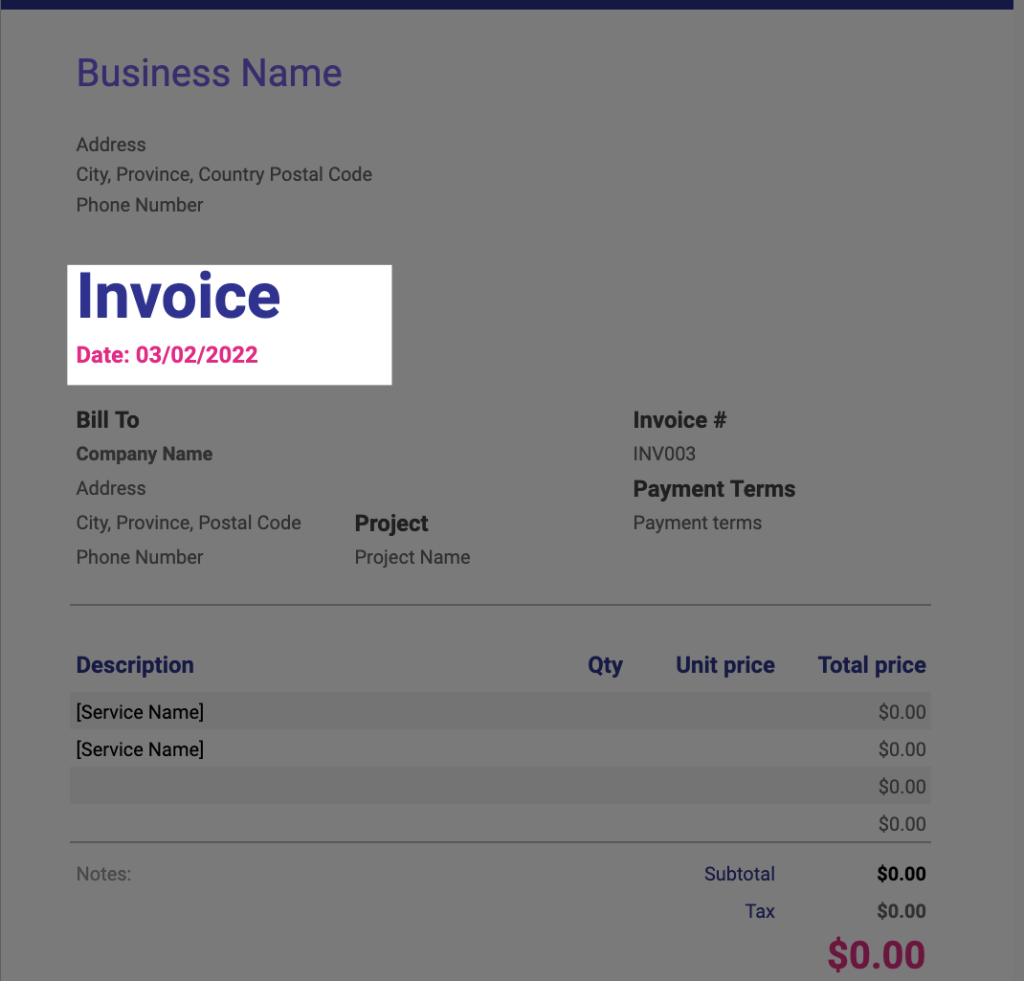

5. Invoice Date

Clearly state the date the invoice is issued. This serves as a reference point for payment due dates and establishes the timeline of the transaction. In the Excel template, fill in the Invoice Date cell

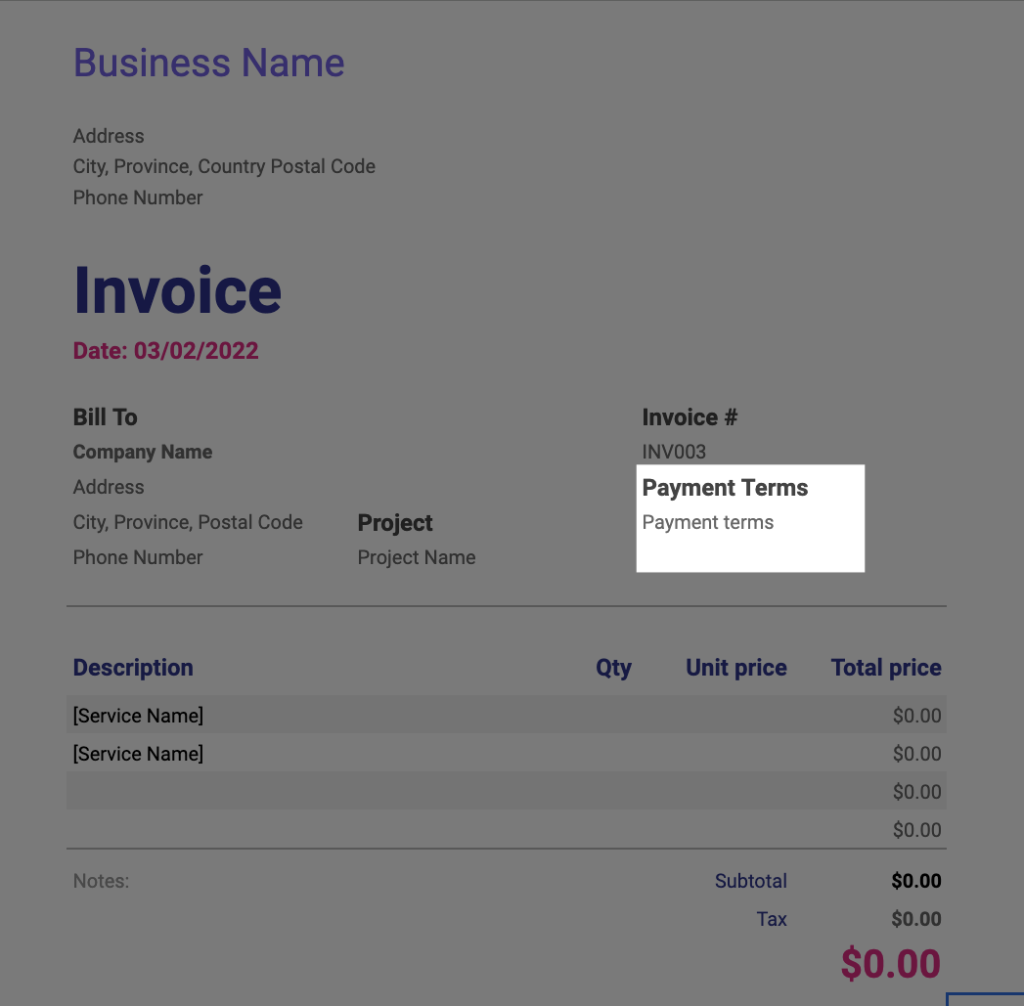

6. Payment Terms

Define the payment terms clearly to avoid confusion. For example, specify whether payment is due upon receipt or within a set period (e.g., 30 days). You can also include late fees or discounts for early payment if applicable.

Common payment terms include:

- Net 30: Payment is due within 30 days of the invoice date.

- Net 15: Payment is due within 15 days of the invoice date.

- Due on Receipt: Payment is expected as soon as the client receives the invoice.

- End of Month (EOM): Payment is due at the end of the month in which the invoice is issued.

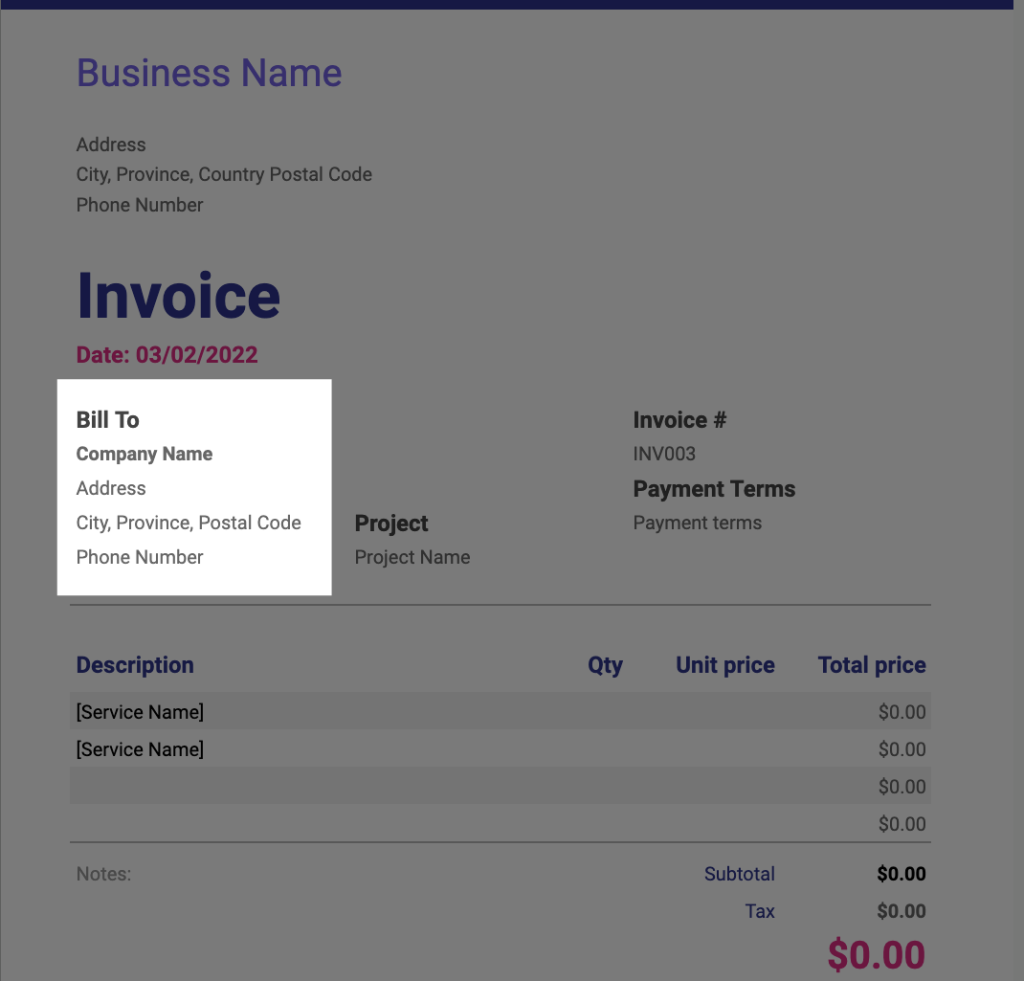

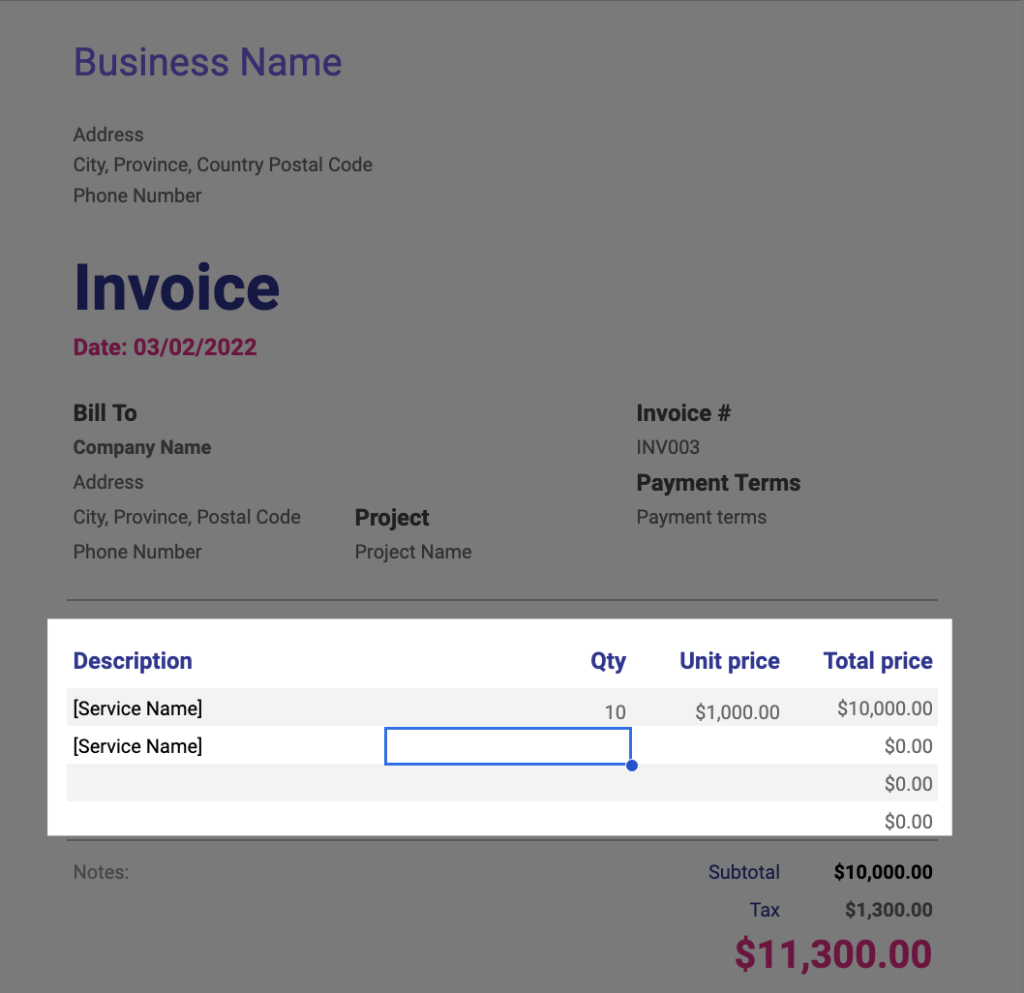

7. Description of Goods or Services

Provide a detailed list of the products or services rendered. In the Excel template, use the Description column to list each item or service, and include:

- Quantity or hours worked

- Unit price

- Total price for each item or service

8. Subtotal

The Excel template will automatically calculate the subtotal of all items or services before any taxes, discounts, or additional fees are applied. Make sure all values are entered correctly so the subtotal is accurate.

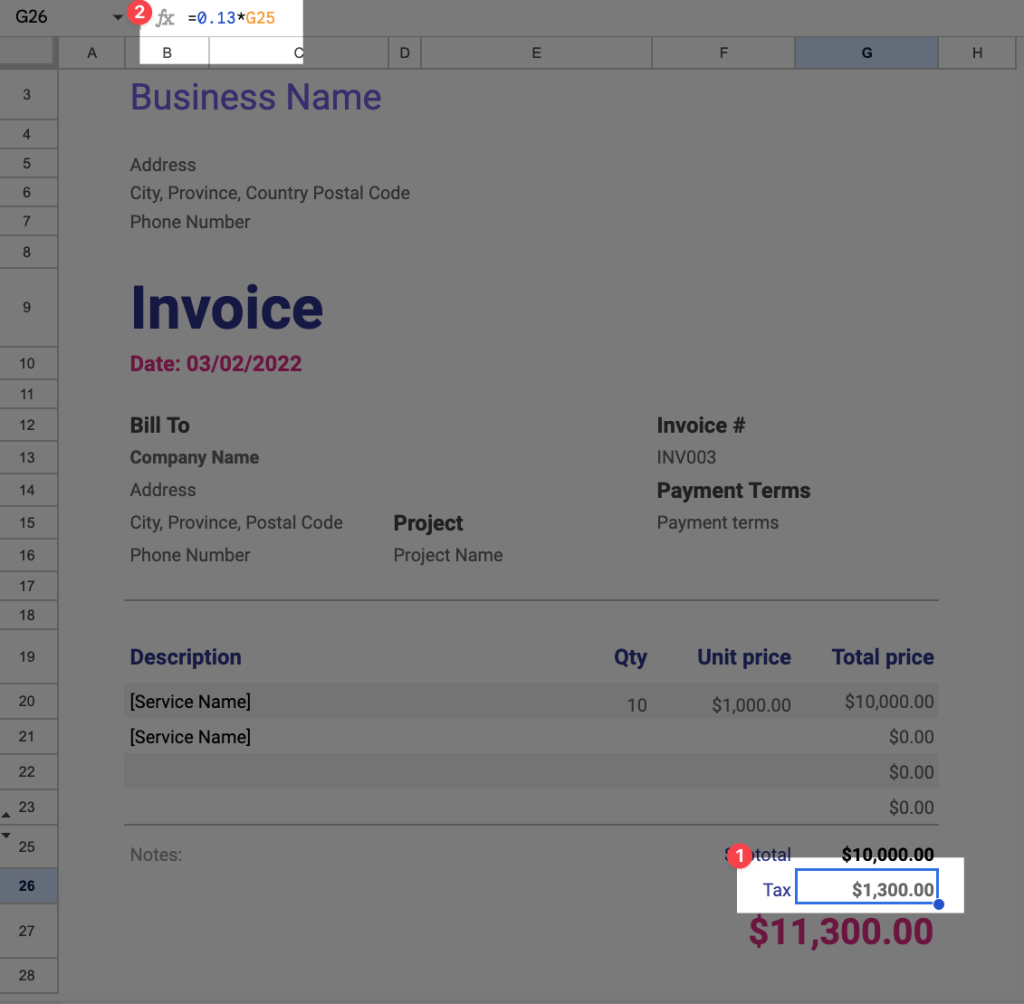

9. Taxes and Fees

List any applicable taxes (sales tax, VAT, etc.) based on your location and the nature of the transaction. In the Excel template, enter the tax rate in the appropriate cell, and it will calculate the tax amount for you.

- Click on the tax cell and navigate to the formula bar

- Replace 0.13 with the tax rate of your area, remember if your tax rate is 13% then you must divide it by 100 to get the rate to put into the formula bar.

10. Total Amount Due

The Total Amount Due cell will automatically add the subtotal, taxes, and any additional fees. This makes it easy to identify the final amount the client must pay, helping to avoid payment delays.

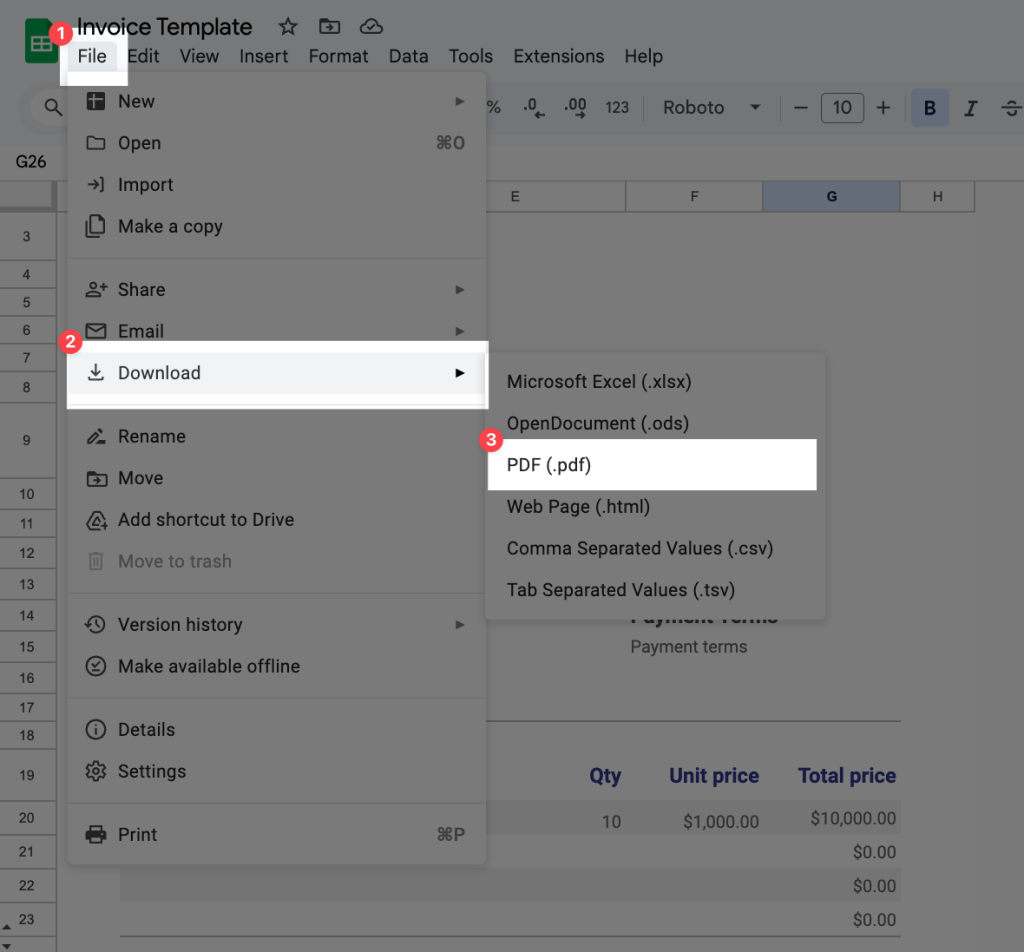

11. Download The PDF

When you finish with the excel template you can easily download the excel sheet as PDF. For instructions look at the screenshot below. Once you’ve downloaded the PDF you can send it off to your client via email!

Tips for Writing a Professional Invoice Using an Excel Template

- Keep it Simple and Clean: Use the provided template’s simple, easy-to-read format. Avoid cluttering the invoice with unnecessary information.

- Use Professional Language: Maintain a professional tone throughout the document to help build trust and credibility with your client.

- Customize Your Invoices: Use the Excel template to add your branding, such as your logo and color scheme, to make it look professional.

- Include a Due Date: A clear due date helps to ensure timely payment. It also gives the client a reminder of when to pay.

- Proofread: Before sending the invoice, double-check for any errors, including incorrect pricing, client information, or payment terms.

Tools and Software to Create Invoices

In addition to using our Excel template, many businesses and freelancers use invoice software to make the process faster and more efficient. SystemX is a great option for consultants and freelancers. It offers many of the tools necessary to succeed in running a freelancing or consultancy. Including:

- Expense reports

- Timesheets

- Electronic signatures

- Invoicing

- Quoting

Common Invoice Mistakes to Avoid

To ensure smooth transactions, it’s important to avoid common mistakes when writing invoices:

- Failing to Include Payment Terms: This can lead to confusion and late payments. Always specify when payment is due.

- Mistaking Client Information: Double-check all client details to avoid sending the invoice to the wrong recipient.

- Not Numbering Your Invoices: A lack of invoice numbers can make it difficult to track payments, especially if you have multiple clients.

- Missing Taxes: Always make sure you include the appropriate taxes or fees to avoid legal issues later on.

Conclusion

Learning how to write an invoice correctly is essential for smooth business operations. Whether you’re a freelancer, small business owner, or contractor, following the steps outlined in this guide will help you create clear, professional invoices using an Excel template that ensures timely payments. Make sure to include all the required elements, avoid common mistakes, and use the right tools to simplify the invoicing process.

For those who want to save even more time, check out our free invoice generator that takes the manual aspects out of the process, making invoicing quicker and more efficient. By keeping your invoices organized and transparent, you’ll not only improve your cash flow but also build stronger relationships with your clients. Happy invoicing!